As you’re itemizing expenses, you notice you may make your own hair merchandise for cheaper than the supplier’s value. Making your own products will prevent $22,000. Both zero-primarily based and traditional budgeting are necessary in creating departmental budgets. If you could have managers of different departments, you may allocate funds to them for the 12 months.

With traditional budgeting, managers are inspired to spend their allowance in order that they don’t lose it. Zero-primarily based budgeting is a bit more frugal, and also you may not see unnecessary spending, since each expense is accounted for. Zero-primarily based budgeting (ZBB) is an approach to creating a budget from scratch. A budget (derived from the old French phrase which means purse) is a quantified financial plan for a forthcoming accounting period. A budget is the sum of money allotted for a particular function and the summary of meant expenditures together with proposals for the way to meet them.

Is Labor a Fixed or Variable Cost?

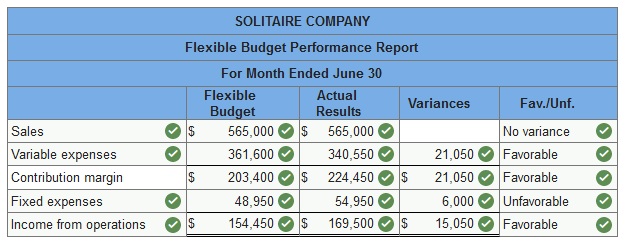

It is outlined because the difference between the precise variety of direct labor hours labored and budgeted direct labor hours that should have been labored primarily based on the standards. Jerry (president and owner), Tom (sales manager), Lynn (manufacturing manager), and Michelle (treasurer and controller) have Bookkeeping been on the meeting described on the opening of this chapter. Michelle was requested to search out out why direct labor and direct materials costs were higher than budgeted, even after factoring within the 5 percent enhance in sales over the initial finances.

When should a fixed budget be prepared?

Definition and example. A flexible budget is a budget or financial plan that varies according to the company’s needs. Flexible budgets calculate, for example, different levels of expenditure for variable costs. These levels vary depending on the changes in revenue.

ACCOUNTING

If you put aside a little bit every month, you gained’t really feel the pressure of an expense abruptly blindsiding you suddenly. You can do that the old-fashioned means with a sheet of paper, Excel spreadsheet, or you can use our free budgeting app,EveryDollar. And after we say revenue, that should embrace paychecks, small-business income, side hustles, residual income, youngster support, and any other cash you bring in.

Business in Action 10.1

The fixed overhead manufacturing volume variance is the difference between budgeted and utilized fastened overhead costs. There isn’t any efficiency variance for fastened manufacturing overhead. Carol’s Cookies anticipated to use zero.20 direct labor hours to supply 1 unit (batch) of product, and the variable overhead rate is $3.50 per hour. Actual outcomes are in for final 12 months, which signifies 390,000 batches of cookies were produced and offered. The company’s direct labor workforce worked ninety seven,500 hours, and variable overhead prices totaled $360,000.

What is flexible budget formula?

Living expenses are expenditures necessary for basic daily living and maintaining good health. They include the main categories of housing, food, clothing, healthcare, and transportation. Housing: Whether you rent or own, there are regular expenses, including some you may not be aware of.

Fast Sleds is disenchanted with the precise outcomes and has employed you as a consultant to provide additional data as to why the company has been struggling to satisfy budgeted web revenue. Your review of the budget introduced previously versus precise analysis identifies variable value of products sold as the primary culprit.

The unfavorable variance for this line item is $eight,seven-hundred. The company’s administration is within the process of creating the standard hours of direct labor required to complete one golf cart.

An equal unit of material or conversion value is the same as __________.

Assume you are the production supervisor, and also you receive a bonus for each quarter that exhibits a favorable labor effectivity variance. That is, you receive a bonus for each quarter exhibiting precise direct labor hours which might be fewer than budgeted direct labor hours. Variance Analysis for Direct Materials, Direct Labor, Variable Overhead, and Fixed Overhead.

Managers must be capable of justify every single expense. Zero-based budgeting may be very tight, aiming to avoid any and all expenditures that aren’t thought-about completely important to the corporate’s profitable (profitable) operation.

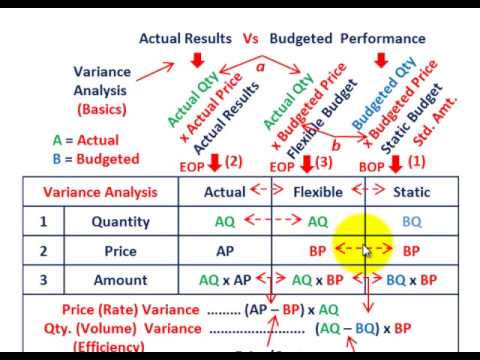

†$one hundred and five,000 normal variable overhead costs matches the versatile finances introduced in Figure 10.2 “Flexible Budget for Variable Production Costs at Jerry’s Ice Cream”. Standard costs are used to ascertain the flexible price range for direct labor. The labor rate variance focuses on the wages paid for labor and is outlined as the distinction between actual costs for direct labor and budgeted costs primarily based on the requirements. The labor effectivity variance focuses on the quantity of labor hours utilized in manufacturing.

- Thus precise fee (AR) isn’t used for this variance.

- 5,600 direct labor hours have been used in the course of the month at a total value of $134,400.

- Assuming the company employs 10 laborers, and the minimum wage within the state of operation is $8, the company has a hard and fast value of $eighty per hour in the form of salaries.

- Variable bills, additionally called variable prices, are bills that may change over time.

- Unlike traditional budgeting, zero-based mostly budgeting doesn’t look at budgets made in prior years.

- Thus, the supplies used as the elements in a product are thought of variable prices, as a result of they range instantly with the variety of units of product manufactured.

Prime prices are a enterprise’s expenses for the elements concerned in manufacturing. Operating costs are expenses associated with the maintenance and administration of a business on a day-to-day foundation.

Standard costs are used to establish the flexible price range for variable manufacturing overhead. The flexible budget is in comparison with precise prices, and the distinction is proven in the form of two variances. The variable overhead spending variance represents the difference between precise costs for variable overhead and budgeted costs primarily based on the standards. The variable overhead effectivity variance calculation presented beforehand exhibits that 18,900 in actual hours worked is decrease than the 21,000 budgeted hours. Again, this variance is favorable as a result of working fewer hours than anticipated should lead to decrease variable manufacturing overhead costs.

If it’s cash and comes into your household’s bank account, it’s revenue! Be sure to write down it down and add it all up in your price range. If you had based your upcoming price range on a previous 12 months’s price range, you may not have realized the totally different bills you would in the reduction of on. But with zero-primarily based budgeting, you make sure that every dollar is accounted for. You resolve to use zero-based budgeting for the upcoming yr.

These commonplace prices can then be used to ascertain a versatile budget primarily based on a given degree of activity. For example, let’s use Jerry’s precise gross sales of 210,000 units https://cryptolisting.org/blog/what-is-the-formula-for-fixed-asset-turnover-ratio. The variable manufacturing prices expected to provide these items are proven in the versatile budget in Figure 10.2 “Flexible Budget for Variable Production Costs at Jerry’s Ice Cream”.

What is Zero based thinking?

Fixed costs are consistent in any given period. Variable costs fluctuate according to the amount of output produced. If you pay an employee a salary that isn’t dependent on the hours worked, that’s a fixed cost. Other types of compensation, such as piecework or commissions are variable.

Deciding not to purchase a costlier pair of sneakers is an example of reducing your discretionary spending. Variable expenses differ from fixed expenses, similar to your mortgage or hire, that stay the same all through the time period of your loan or lease. Unlike fixed bills, variable bills can change significantly over the course of a week, a month, or a year. Comparing flexible vs. static budgets, versatile finances allows industrial organizations to effect an accurate comparability between budgeted performance and actual efficiency.

Managers observe the targets and impose budget targets for activities and prices. It could be effective if an organization is in a turnaround state of affairs the place they need to meet some difficult goals, but there may be very little goal congruence. starts with the belief that each one division budgets are zero and should be rebuilt from scratch.

Our Company

Lynn was shocked to be taught that direct labor and direct materials prices had been so high, notably since actual materials used and precise direct labor hours worked had been below budget. The normal price offered in Figure 10.1 “Standard Costs at Jerry’s Ice Cream” shows the variable manufacturing prices anticipated to provide one unit. Later in the chapter, we examine the flexible budget introduced in Figure 10.3 “Flexible Budget” to actual results and analyze the difference.

Assume Hal’s Heating produced 320 furnaces throughout January. Direct Materials Standard Cost and Flexible Budget.

The total operating value for a company consists of the price of goods offered, working bills as well as overhead expenses. Next, take into consideration What is the difference between a flexible budget and an actual budget? all of the irregular expenses that can pop up. Things like automobile tag renewal fees, property taxes, HOA dues, and even your insurance premiums can be budgeted for forward of time.

What is production budget example?

To compute the value of the flexible budget, multiply the variable cost per unit by the actual production volume. Here, the figure indicates that the variable costs of producing 125,000 should total $162,500 (125,000 units x $1.30).

The master budget exhibits the following standards data and signifies the company anticipated to provide and promote four,000 items for the month of May. Assume Hillside Hats, LLC, uses exercise-primarily based costing to allocate variable manufacturing overhead prices to products. The firm identified three activities with the next data for last month.

That’s why a versatile budget could be very effective for corporations who go through lots of adjustments during a particular period. It is much more complex than the fastened budget too.

FINANCE YOUR BUSINESS

This sort of backside-up budgeting can be a extremely efficient approach to “shake things up”. Flexible finances, on the other hand, is a finances that is flexible as per the wants of the hour. For instance, if the company sees that it can dump more of its merchandise by expending extra in commercial costs, a versatile price range would help execute that.

It might embody a price range surplus, offering money for use at a future time, or a deficit in which expenses exceed earnings. Once you’ve created your finances and you’re able to take it off of the paper and play it out, you will want to divide it into three categories. First, learn bookstime the distinction between mounted, variable, and financial savings costs, after which grab three completely different colored highlighters and start going via your budget, line by line. Trimming variable bills is more difficult than slicing discretionary spending.

Retaining the price range values to mirror a manufacturing of 9,000 models would indicate cost overruns or a distorted per-unit production price. Insurance premiums and rent, for example, are mounted costs.

Each chair requires a normal amount of 10 board toes of wood at $5 per board foot. Calculate (a) standard price per unit for direct supplies and (b) versatile finances quantity for direct supplies for the month of July. Total production of 210,000 items × Standard price of $4 https://cryptolisting.org/.50 per unit equals $945,000; the same amount you see in the entry offered previously. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. The mounted overhead spending variance is the distinction between precise and budgeted fastened overhead costs.