Accrual Accounting Vs. Cash Basis Accounting: An Overview

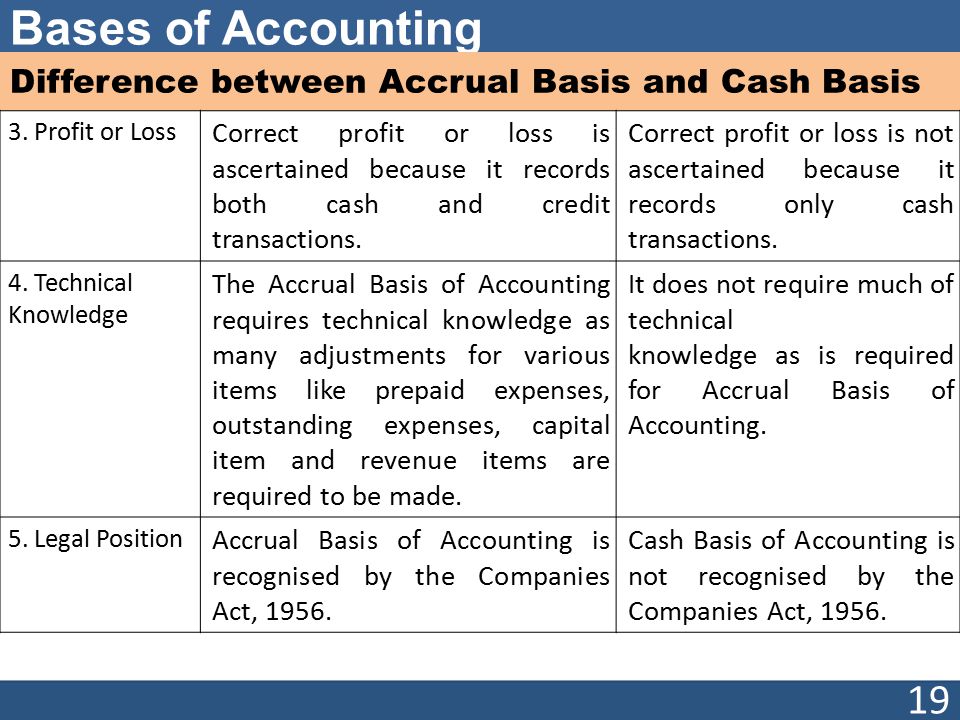

This differs from the cash basis of accounting, under which a business recognizes revenue and expenses only when cash is received or paid. Two concepts, or principles, that the accrual basis of accounting uses are the revenue recognition principle and the matching principle. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out. This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid.

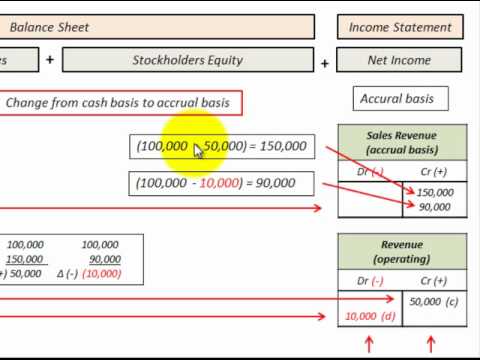

Recording an amount as an accrual provides a company with a more comprehensive look at its financial situation. It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. There are two methods for recording accounting transactions such as cash basis and accrual basis. The accrual basis and cash basis accounting are two different accounting methods. The main difference between the two methods is in the timing of transaction recordation.

Cash Basis Accounting

What are accruals give 2 examples?

Accrual Accounting. Definition: Accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged. The term “accrual” refers to any individual entry recording revenue or expense in the absence of a cash transaction.

As a result, wide swings (distortions) in financial results can occur over two or more accounting periods. The hybrid method combines the accrual and cash methods of accounting.

The upside is that the accrual basis gives a more realistic idea of income and expenses during a period of time, therefore providing a long-term picture of the business that cash accounting can’t provide. The result is that a company’s reported expenses typically differ from the amount of cash it paid for expenses in a particular period. https://onroad.mx/2020/04/06/a-guide-for-supporting-remote-student-book-clubs/ A construction company secures a major contract but will only receive compensation upon completion of the project. Using cash-basis accounting, the company is only able to recognize the revenue upon project completion, which is when cash is received. However, during the project, it records the project’s expenses as they are being paid.

If you have the option to use either accounting method, it pays to consider whether switching methods would lower your tax bill. With the accrual method, income and expenses are recorded as they occur, regardless of whether or not cash has actually changed hands.

When Are Expenses And Revenues Counted In Accrual Accounting?

Business expenses are deducted in the business year they were paid. It’s a simple, straightforward way to calculate income and expenses.

Incomeis recorded when it’s received, and expenses are reported when they’re actually paid. From a tax standpoint, it is sometimes advantageous for a new business to use the cash method of accounting. For example, say that a company pays its annual rent of $12,000 in January, rather than paying $1,000 per month for the year. The cash basis would recognize a rent expense for January of $12,000, since that is when the money was paid, and a rent expense of zero for the remainder of the year.

All general QuickBook reports show income and expenses accrued instead of paid when you set up your company on an accrual basis. You record income when you create an invoice for a completed project or sale of goods, and record expenses when you receive a bill. Your profit/loss report coincides directly with work completed and expenses incurred, but it’s only bank account registers in QuickBooks that show cash on hand.

Cash accounting is an “after the fact” accounting style, while accrual accounting is done in real time. According to World Bank, accrual accounting makes it easy for business managers to plan the future.

- Any unsettled invoices or unpaid bills are not recorded until they are completed.

- With cash basis accounting, income and expenses are recorded as they are paid.

- A business that uses the accrual basis of accounting recognizes revenue and expenses in the accounting period in which they are earned or incurred, regardless of when payment occurs.

In aggregated over time, the results of these two methods are approximately the same. With the accrual accounting method, contra asset account income and expenses are recorded when they’re billed and earned, regardless of when the money is actually received.

Under the accrual basis, revenue is recognized when earned and expenses when incurred. Under the cash basis, revenue is recognized when cash is received and expenses when bills are paid. The accrual basis involves more complex accounting, but results in more accurate financial statements. The cash basis is relatively easy to use, and so is preferred when the accounting staff is small and less well trained. Which accounting method should your business be using for tax purposes?

What is an accrual in simple terms?

QuickBooks converts accrual to cash reports by removing the unreceived income and the unpaid expenses from the report.

Income on the cash basis only includes income that your customers have paid to you. Expenses on the accrual basis include everything you owe, regardless of whether or not you have sent a payment. Expenses on the cash basis include only the expenses that you have already paid. The cash method is the most simple in that the books are kept based on the actual flow of cash in and out of the business.

For example, if you have yet to pay your bills for the month, cash basis accounting could lead you to believe that you have more money than you actually do. The cash method is pretty straightforward, as there is no need cash basis vs accrual basis accounting to keep track of things like accounts receivables and accounts payables. Just like in tracking your personal financial records, cash accounting is as easy as listing revenue and expenses as you receive/spend them.

As per accrual basis, we record revenues and expenses when they accrue, regardless of the actual receipt or payment of the amount. The cash basis is only available for use if a company has no more than $5 million of sales per year (as per bookkeeping the IRS). It is easiest to account for transactions using the cash basis, since no complex accounting transactions such as accruals and deferrals are needed. Given its ease of use, the cash basis is widely used in small businesses.

A business that chooses to use the accrual basis must use it consistently for all financial reporting and for credit purposes. For anyone who runs two or more businesses, however, it is permissible to use different accounting methods for each. Accrual accounting, normal balance on the other hand, is a more complex accounting method. In accrual accounting, you record income and expenses whenever a transaction takes place, even if you don’t physically receive or pay. You use more advanced accounts, like Accounts Receivable and Payable.

We go over cash basis accounting and accrual basis accounting so you know the pros and cons of each method and which is best use for your small business accounting. Businesses that use cash basis accounting recognize income and expenses only when money changes hands.

Corporate Cash Flow: Understanding The Essentials

You only have to pay tax on money you’ve received, rather than on invoices you’ve issued, which can help cash flow. But not all businesses are allowed to use cash basis accounting for tax.

What Is Cash Basis Method Of Accounting?

In other words, you record both revenues—accounts receivable—and expenses—accounts payable—when they occur. Some small businesses can choose the hybrid method of accounting, wherein they use accrual accounting for inventory and the cash method for their income and expenses.